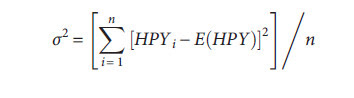

To measure the risk for a series of historical rates of returns, we use the same measures as for expected returns (variance and standard deviation) except that we consider the historical holding period yields (HPYs) as follows:

The standard deviation is the square root of the variance. Both measures indicate how much the individual HPYs over time deviated from the expected value of the series. An example computation is contained in the appendix to this chapter. The standard deviation as a measure of risk (uncertainty) for the series or asset class is fairly common.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)